I

Ikenna Ngere

Guest

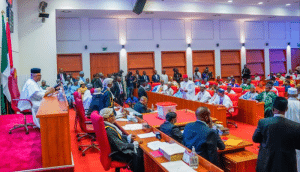

The Senate, in its Tuesday session, passed a notable bill targeting the enhancement of the Nigeria Deposit Insurance Corporation’s (NDIC) capacity to safeguard depositors’ funds and solidify financial institutions across the country.

The bill, titled the “Nigeria Deposit Insurance Corporation Act 2023,” was approved following the review of the Senate Committee on Banking, Insurance, and Other Financial Institutions’ report.

Senator Adetokunbo Abiru (APC-Lagos) sponsored the bill, supported by all committee members.

In his presentation, Abiru emphasized that the new legislation would bolster the NDIC’s effectiveness, ensuring its independence and autonomy while aligning it with modern standards and best practices.

Key changes in the bill include consolidating the authority of the President to appoint the NDIC’s Chairman and board members.

Previously, the Central Bank of Nigeria (CBN) was responsible for recommending appointees, but under the new provisions, the CBN will shift its focus to supervising the NDIC.

Abiru noted, “The Nigerian Deposit Insurance Corporation (Amendment) Bill, 2024, is thus a critical piece of legislation aimed at strengthening the Nigerian financial system.

“The proposed amendments will enhance the NDIC’s capacity to safeguard depositors, ensure the stability of financial institutions, and promote trust in the banking system.

“Given the rapidly evolving nature of the financial sector, this Bill represents a timely response to the challenges and opportunities that lie ahead.”

The bill also seeks to ensure the NDIC’s independence by aligning it with Section 1 (3) of the principal Act.

It modifies previous restrictions that limited the President’s appointment powers regarding the Managing Director and Executive Directors, now allowing appointments consistent with the constitutional provisions of the Federal Republic of Nigeria, 1999.

Additionally, the bill revises the stipulation that designated the Permanent Secretary of the Ministry of Finance as the Board Chairman, citing the role’s demanding responsibilities as a reason for the change.

He said, “To further empower the corporation by guaranteeing its independence in performing its statutory functions in line with Section 1 (3) of the principal Act.

“The principal (2023) Act curiously restricts the President’s power to appoint the Managing Director and Executive Directors and provides that they are to be to persons recommended by the Central Bank of Nigeria Governor.

“The 2024 bill now seeks to amend the provision to bring it in line with and in consonance with Mr President’s power of appointment as enshrined in the Constitution of the Federal Republic of Nigeria 1999 as amended.

“The provisions of the principal Act which makes the Permanent Secretary, Ministry of Finance the Chairman of the Board is also being reviewed.

“This is because the workload and busy schedule of that office is such that makes such appointments untenable.

“The importance of the need for the Minister of Finance to constitute an Interim Management Committee for the Corporation within 30 days after the expiration or termination of the tenure of the Board is also introduced in the bill.

“This is to forestall the recent situation where the Corporation faces challenges in its operations as a result of the absence of a board.”

Abiru highlighted the widespread agreement among stakeholders regarding the NDIC’s essential role in protecting depositors and ensuring the settlement of insured funds, which is crucial for maintaining financial system stability.

“Considering the above, therefore, the general consensus among stakeholders was that it is important that the legal framework is reviewed.

“This is to make the corporation more effective to discharge its functions, safeguard its independence and autonomy and to bring it in line with current realities and best practices.

“This is particularly because the Corporation plays a vital role in safeguarding the interests of depositors and promoting confidence in the financial sector.

“The evolving challenges in the global and domestic banking environments necessitate the amendment of the current law to keep pace with these developments and ensure the NDIC remains fit for purpose,” he concluded.

The post Senate Passes NDIC Bill To Safeguard Bank Depositors’ Fund appeared first on Naija News.